Summary of Freight House STAR Bond District

6/29/09 - I have received a TON of requests to provide a summary of each STAR Bond, so here we go, and these are all based on City of Reno staff reports. Let's start with the Freight House. This involved quite a bit of work, so I'll do the Tessera STAR Bond District this evening.

Freight House STAR Bonds

Overview...

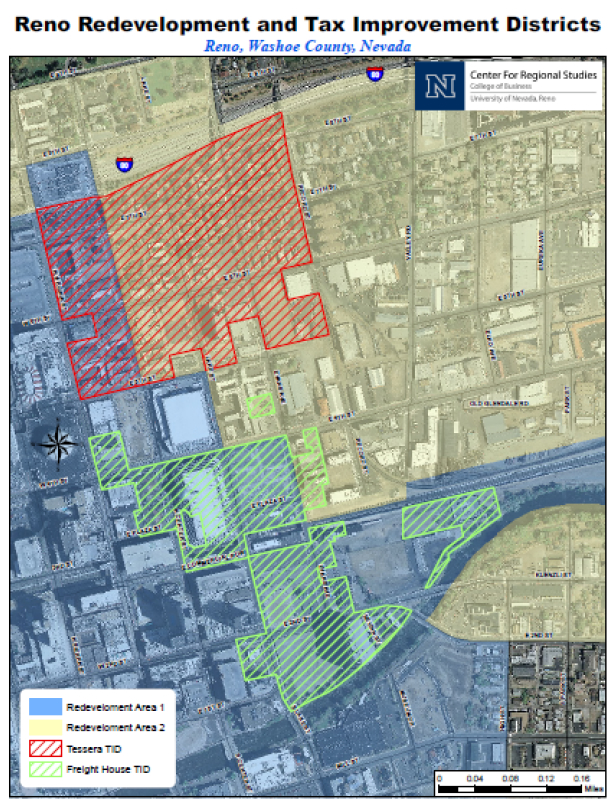

This outlines the history and report findings for the STAR Bond District proposed for the 'Freight House District', You can click the Map button to see the proposed boundaries of this district. The final build out of the project includes retail on the Mizpah and parking lot properties between Evans and Lake and 2nd and the ReTRAC trench. The proposed district then weaves west to include portions of the bowling stadium and current RTC CitiCenter, where eventually retail supporting the Reno Aces ballpark will be built. I have rehashed what STAR Bonds are and how they work many times over, so this will focus in on the specific STAR Bond District for the Freight House. Click through the tabs to learn more. The history is quite fascinating, and there were many many meetings to get this far, including at least 3 Citizens Advisory Committee meetings, multiple City Council/Redevelopment Agency Board meetings, School Board meetings, Washoe County Commissioner meetings, and more.

History...

I am including this history, which I tried to make as accurate as possible, so everyone can see the multitude of opportunities for public comment during this long long process thus far. Meeting after meeting after meeting, and I was at a good portion of them.

September 21, 2007 - the Agency requested and obtained authority from the City Council/Agency Board to engage in the negotiation of memoranda and agreements to enable the development of a mixed-use project anchored by an AAA Ballpark and commercial retail facilities. Nevada Land II LLC has issued a request for assistance on the proposed project located in the Baseball District, which will be anchored by the Stadium and center specializing in destination retail and entertainment venues.

The proposed Freight House District Project anticipates the use of SB306, Tourism Improvement District (TID) Bonds. Per State Law, in order to utilize Sales Tax Anticipated Revenue (STAR) Bonds, a Fiscal Impact and Economic Impact Analyses of the project and its effects on local governmental services and revenues [together with an assessment of the total economic impact of the project] must be completed.

June 26, 2008 - The City Council and the Agency Board authorized the impact study at their Joint meeting.

July 16, 2008 - A Memorandum of Understanding (MOU) among the City, the Redevelopment Agency of the City of Reno and Nevada Land II LLC to commence the feasibility study required to establish a tourism improvement district (NRS 271A.120 and NRS 271A.080) and assess the feasibility of the proposed project was approved.

January 6, 2009 - Citizens Advisory Board Meeting, the Tessera and L3 Development STAR Bond Districts were discussed.

January 20, 2009 - City of Reno Financial Advisory Board, STAR Bonds were discussed with the Redevelopment Agency Board as a primer of the process.

February 3, 2009 - City of Reno Financial Advisory Board meeting - 3 STAR Bond Districts (Tessera, Ballpark, L3 Development) were discussed.

The report was transmitted to the Washoe County School Board of Trustees, as well as to the Washoe County Commission, 45 days prior to the hearing on July 1, 2009.

June 10, 2009 - joint Redevelopment/City Council meeting for the presentation, discussion and direction to staff regarding the Fiscal Impact and Economic Impact Analyses conducted by Meridian Business Consultants for the proposed use of STAR Bonds for the Freight House Project and staff was directed to return June 26, 2009 with updates to the reports.

June 23, 2009 - The School Board considered the item during its meeting scheduled on June 23, 2009; the Board of Commissioners also considered the item during its meeting. The Washoe County School Board of Trustees approved support for the STAR Bond Baseball Stadium/Freight House Tourism Improvement District (TID) with the understanding that the school district believes there is a fiscal impact created by this TID. To help mitigate some of the impact, the developer has offered to contribute an additional .5625% LSST that normally stays with the TID back to the school district with this funding directed to a WCSD capital account for school revitalization (this offer is on top of the 25% {or .5625%} LSST that the school district would already receive by law for these projects, so the total LSST to the WCSD from this TID would be 1.125%.)

June 26, 2009 Joint City Council/Redevelopment Meeting - presentation, discussion and direction to staff regarding the Fiscal Impact and Economic Impact Analyses conducted by Meridian Business Consultants for the proposed use of STAR Bonds for the Freight House Project was further reviewed by the consultants and the City council to vet further questions. The report was amended to show several different scenarios, including preponderance when both districts were taken into account simultaneously.

Should the City Council make the findings associated with NRS 271A (outlined below) on July 1st, then, the next steps would be to forward the project to the Nevada Commission on Tourism and the Governor. If those approvals have been obtained, the project comes back to the City Council/Agency Board for creating the boundary of the Tourism Improvement District by ordinance. Fun yeah?

Preponderance

There are some determinations that have to be made by the City Council via a third-party report, which Meridian Business Advisors performed. Those findings include:

- whether the Project and the financing thereof will have a positive fiscal effect on the provision of local governmental services

- the Project will benefit the proposed “Tourism Improvement District” (TID) to be created,

- As a result of the Project: (1) retailers will locate their businesses as such in the District, and (2) there will be a substantial increase in the proceeds from sales tax revenue; and (b) a preponderance of that increase in the proceeds from the sales and use taxes will be attributable to transactions with tourists who are not residents of the State of Nevada.

Meridian Business Advisors had to make some revisions to the report based on some requests by the city council. Below are the revised findings for this report.

The findings for City Council to make on Wednesday are:

1. Preponderance - A preponderance of the increase in the proceeds from sales and use taxes will be attributable to transactions with tourists who are not residents of this State. The Freight House project has up to 62% of the development’s retail and food/beverage made by out-of-state visitors. It is important to note that the legislation does not say this has to be new tourists.

2. Displacement - Regarding displacement, the consultant’s study indicates the development’s estimated retail sales generated at build-out will more than be absorbed by the demand from increased population and increased spending by downtown hotel visitors. No impact on competitive retail vendors is anticipated. The study does not anticipate any competitive product or vendor will be displaced due to the development's sales. A good example of this is the fact that many businesses surrounding the baseball stadium have generally seen an increase in business due to more visitors traveling to downtown, not a downturn. Being also a catalyst project Téssera should have the same results. No negative impact on existing competitive retailers is anticipated.

3. Positive Fiscal Impact Analysis - The governing body has made a determination as to whether the project and the financing thereof will have a positive fiscal effect on the provision of local governmental services. Below lists the Fiscal impacts of the development:

a. City of Reno General Fund - Estimated $29.2 million from various revenue sources over 20

years. Estimated cost to provide services to the Development is $19.6 million over 20 years. Cumulative revenue surplus over 20 years is estimated at $9.5 million.

b. Reno Redevelopment District - Estimated $183.9 million in property tax revenue over 20 years.

c. Tourism Improvement District - Estimated $164.9 million in sales tax revenue over 20 years.

4. Benefit to the District - The governing body has made a written finding at a public hearing that the project will benefit the district. The Freight House project is estimated to create $80.5 million in sales tax revenue for Cities of Reno and Sparks, Washoe County, Washoe County School District, State of Nevada, Special Districts and Enterprise Districts. Regional economic impact estimated at $923 million through the first full year of operation regional employment impact estimated at 5,700 jobs, of which 3,200 will be permanent.

Maps...

.

.

Comments:

Post your commentsNo comments posted.